The European M&A market saw record trends in 2015, with Q4 2015 being the highest ever quarter for deal value in Europe, exceeding €420billion[1]. A weakening euro resulted in strong US investment playing an important role, and amounting to over US$ 208 billion. This seems to have particularly fuelled European M&A, which saw deal values increase 40% in the first quarter of 2016, compared to the same period in 2015, despite uncertainty in Europe in the lead-up to the UK referendum on retention of its EU membership.[2]

The increasingly international nature of transactions is evidenced by the fact that cross-border M&A represents significant proportions of overall activity. The key challenge in structuring deals of this nature is to minimise costs for the purchaser, both in terms of professional fees and importantly, tax liabilities. Gibraltar provides unique attributes which make it an ideal international financial centre for structuring M&A transactions.

The recent decision of the UK to leave the EU will affect Gibraltar, which depends on the UK’s EU status for its own membership. While this has inevitably created a period of uncertainty, the EU methodologies discussed in this article will certainly remain available until such time as Article 50 of The Lisbon Treaty is triggered by the UK government and EU law ceases to be applicable to the UK.

1. Membership of the EU

Companies looking to enter into the European single-market can use Gibraltar as a gateway to Europe. In contrast with the other international financial centres, it is often compared to, such as Jersey or Guernsey, Gibraltar’s membership of the EU enables a Gibraltar company to passport services throughout Europe at low cost, with the support of a cooperative, easily accessible, responsive and business-focused regulator. These factors make Gibraltar an attractive location for inbound European M&A activity from the US and Asia.

A Gibraltar vehicle could also be used for the structuring of deals involving other EU member state companies, which is facilitated by the fact that Gibraltar has transposed the Cross Border Merger Directive (“the CBMD”).

The CBMD facilitates cross-border M&A activity for limited companies by providing a simple framework drawing largely on national laws applicable to domestic mergers. This avoids the sometimes prohibitively high costs of cross-border M&A deals, as well as avoiding the winding up of the target company. A Gibraltar company can merge with a company registered in any other EU member state. Interestingly, the CBMD does not operate between Gibraltar and the UK, which are not deemed to be the separate EU Member States for this purpose. The same result can be obtained, however, by undertaking two cross-border mergers, one between the Gibraltar company and a company registered anywhere in the EU, and another between that company and the UK company.

Gibraltar’s EU membership and first class regulatory regime means that holding structures or special purpose vehicles in Gibraltar will be fully compliant with the standards expected by the European Commission and applicable tax laws. This, coupled with Gibraltar’s adoption of EU standards of administrative co-operation in the field of taxation and other tax information exchange regimes, resulted in Gibraltar scoring “largely compliant” in its review by the OECD. This reputation facilitates dealings with third parties, ensuring lack of transparency does not hinder the business.

2. Flexible company law regime for modern-day transactions and business-focused tax laws

- Corporate law and tax regime

Gibraltar overhauled its Companies Act in 2014, to include some features which make Gibraltar companies attractive for structuring acquisition vehicles and facilitating M&A activity. Gibraltar corporate vehicles enjoy the flexibility of the English common law; a legal regime which is widely used and preferred by businesses around the world. A Gibraltar company only requires one director and one secretary (which can be corporate entities), with no requirements for agents or resident directors (although the location of management and control can determine the company’s tax residence). There is no limit on the number of shareholders a company can have, which enables a Gibraltar company to be funded easily with a large share capital, which would be subjected to a fixed capital duty of only £10. It is also possible to have different share classes, such as redeemable shares, or shares with preferential rights to dividend and/or a return of capital on a winding up. There are no minimum capital requirements and share capital can be denominated in any lawful currency. Shares can be issued per any value and at a premium. Nominee shareholdings are also permitted.The taxation of companies are relatively simple, and also facilitate business needs. All companies are chargeable on taxable profits accrued and derived in Gibraltar, at a fixed rate of 10%. Capital gains are not taxed, and no withholding tax is imposed on the payment of interest or dividends. Interest income is generally not taxable, unless it is inter-company loan interest that is received by or accrues to a company and is in excess of £100,000 p.a. Furthermore, the transfer of shares in a Gibraltar company is not subject to any tax or duty, unless the company whose shares are transferred holds Gibraltar real estate.

- Gibco as an investment vehicle

Gibraltar Private Limited companies are able to convert to public companies, as well as a number of different forms. The shares of Gibraltar companies have been listed on international recognised stock exchanges, such as the London Stock Exchange. The fact that capital gains are not taxed makes an IPO for institutional investors and private equity houses to be attractive. It is also possible for Gibraltar companies to return capital to shareholders (e.g., by delivering redemption proceeds on a redemption of the shares) as opposed to distributing profits by way of dividend.The fund industry in Gibraltar has been growing at a rapid pace and continues to expand. There are many types of fund in Gibraltar, including private funds, Experienced Investor Funds (EIFs), Non-UCITS Retail funds and protected cell companies. This makes Gibraltar a serious option for basing investment funds.

3. Mergers and schemes of arrangement

Mergers are possible for public companies, and the Companies Act 2014 provides a framework for reconstructions and schemes of arrangement. The recent prohibition on cancellation schemes of arrangement in the UK (by virtue of the Companies Act (Amendment of Part 17) Regulations 2015) has resulted in stamp duty payments on the transfer of shares being an additional cost to a purchaser. Given that cancellation schemes were the overwhelmingly preferred structure for conducting high value acquisitions, the closure of this loophole has resulted in a significant increase in costs involved in an acquisition. While the rate of stamp duty in the UK is currently only set at 0.5%, this can amount to a significant quantity in a high-value M&A deal. Purchasers of UK businesses may therefore consider whether the stamp duty saving could be retained by using Gibraltar to structure the deal.

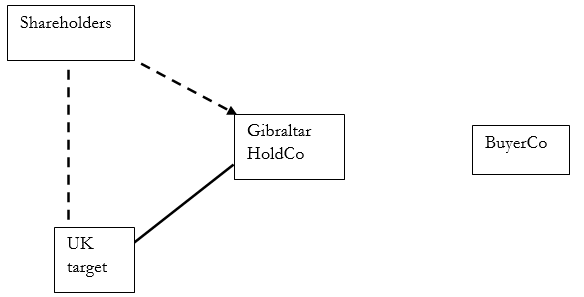

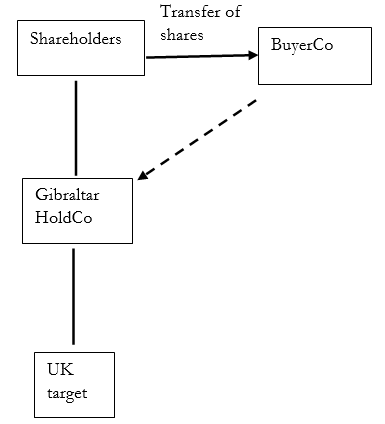

The UK prohibition on cancellation schemes does not prevent a cancellation scheme of arrangement from being used to insert a holding company over the target company. It is possible therefore, to insert a Gibraltar holding company over the UK target, by cancelling the shares in the UK company in consideration for issuing to the shareholders, new shares in a Gibraltar company which will hold shares in the target. A purchaser could then acquire the shares in the Gibraltar company by way of a share transfer.

The shares of a Gibraltar company with a share register maintained outside the UK are not subject to stamp duty in the UK. In Gibraltar, no stamp duty is payable on shares (unless the transaction involves real estate located in Gibraltar). In an increasingly cost-conscious market, this can amount to a significant saving for the purchaser.

The proposal is illustrated below:

- Shares in UKCo cancelled, in consideration for the issuing of shares in Gibraltar HoldCo

- BuyerCo purchases shares of Gibraltar HoldCo. No stamp duty is payable in the UK on shares in Gibraltar companies and no stamp duty on shares in Gibraltar.

In addition, there would be no tax on the dividends received from the UK target to the Gibraltar HoldCo, and no withholding tax on dividends paid from Gibraltar HoldCo to the BuyerCo. Corporation tax would only be on profits accrued and derived in Gibraltar, at a flat rate of 10%.Furthermore, the lack of VAT provides significant savings on professional fees.

4. Redomiciliation

Gibraltar law permits redomiciliation of companies registered in a number of other countries to Gibraltar, as well as the redomiciliation of Gibraltar companies elsewhere. This can be vastly helpful in the context of M&A transactions. In the above example, for instance, companies incorporated and registered in jurisdictions which do not recognise the scheme of arrangement, who wish to take advantage of the benefits structuring the acquisition in this way can provide redomicile under the Companies Act 2014. Once redomiciled to Gibraltar, the scheme of arrangement provisions under Gibraltar corporate law can be utilised. Similarly, after completing an M&A transaction, the new business may consider redomiciling to Gibraltar to take advantage of the competitive and flexible taxation and legal regime.

Companies registered in any of the following jurisdictions may redomicile into Gibraltar:

Any of the EEA States, Anguilla, Bermuda, British Antarctic Territory, British Indian Ocean Territory, Cayman Islands, Falkland Islands, Guernsey, Isle of Man, Jersey, Montserrat, Pitcaim, St. Helena, Turks and Caicos Islands, British Virgin Islands, States which are members of the British Commonwealth, Liberia, Panama, Singapore, Switzerland, Hong Kong and the USA.

The arrangements are reciprocal, so a Gibraltar company is also able (subject to local laws) to redomicile into any of the above-listed jurisdictions.

Upon a redomiciliation, a company continues in uninterrupted existence, so the assets and liabilities, rights and obligations of the company remain as they are in the original state, which further facilitates post-acquisition synergies.

5. SocietasEuropaeas

The Companies Registrar in Gibraltar recognises and registers SocietasEuropaeas, which also facilitates cross-border M&A activity.. Such entities are able to transfer their registered office from one EU member state to another, without having to comply with the more onerous procedure to migrate a company, which involves the transfer of assets and liabilities, dissolutions and re-incorporations. A SocietasEuropaeas can be formed by a merger between two public companies in different EU Member States. This may be of particular benefit to companies in the gaming sector, as many of the largest providers in the gambling market operate out of Gibraltar.

6. Conclusion

At a time where clients are more cost-conscious than ever, structuring a merger or acquisition effectively, while keeping costs and tax-liabilities at a minimum is key. Gibraltar offers a variety of mechanisms for M&A deal structures, as well as post-transaction corporate group structuring. Gibraltar boasts a diversified economy which is rapidly growing in sectors such as financial services, gaming, shipping and tourism. Despite the uncertainty and instability resulting from the UK’s decision to exit the EU, the legal matrix in which the market operates remains unchanged. Following 2015 as a record year in the European M&A market, 2016 may see Gibraltar featuring increasingly on the radars of M&A professionals, indicating that notwithstanding its small size, Gibraltar has a lot to offer.

[1]Deloitte“Impact of the EU referendum on M&A activity in the UK” accessed on 5th August 2016 on https://www2.deloitte.com/content/dam/Deloitte/uk/Documents/international-markets/deloitte-uk-impact-of-the-eu-referendum-on-ma-activity-in-the-uk.pdf

[2]Ibid